In July 2025, Allianz Life‘s US subsidiary experienced a significant data breach affecting approximately 1.4 million customers, representing the majority of its consumer base. This incident, identified on July 17, one day after the intrusion, raised immediate concerns regarding the security of personally identifiable information (PII) within the organization.

Although Allianz Life has nearly 2,000 employees in the US, some of whom were likewise impacted, the breach was reportedly limited to this subsidiary and did not compromise other Allianz SE entities.

The breach primarily affected Allianz Life’s US subsidiary, leaving other Allianz SE entities unaffected.

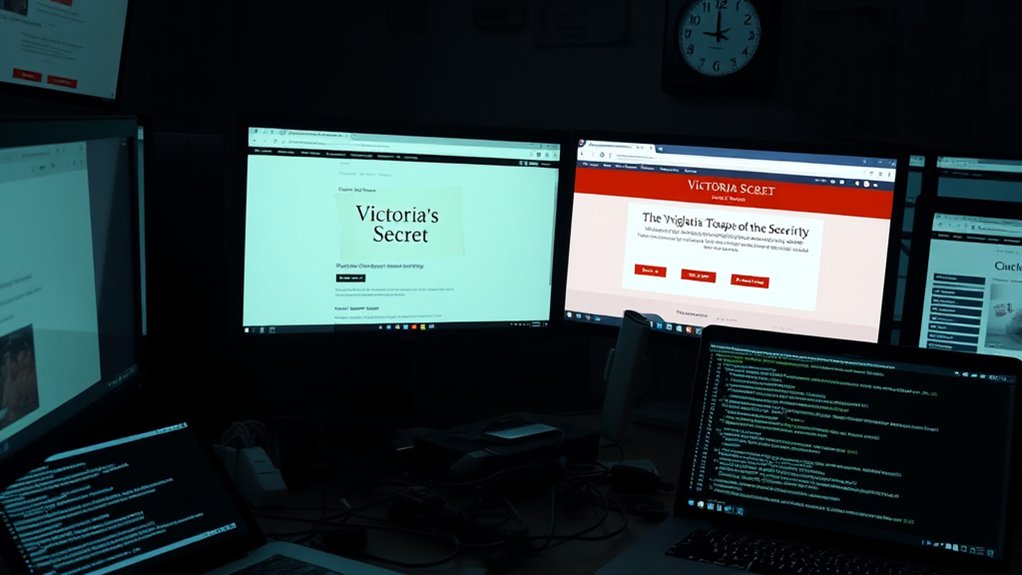

The breach occurred when a threat actor exploited a third-party cloud-based customer relationship management (CRM) platform. Initial access was gained through socially engineered tactics aimed at employees, emphasizing the importance of human factors over technical vulnerabilities in cybersecurity. In particular, the attack exploited a third-party, cloud-based system that highlights the risks associated with such platforms.

Investigations revealed no evidence that Allianz’s internal systems or policy administration systems had been accessed, indicating that the attack vector primarily targeted human susceptibility rather than an inherent flaw in the company’s infrastructure.

Sensitive customer data, which included PII of financial professionals and selected employees, was stolen, increasing the risk of identity theft for a significant portion of Allianz Life’s US clientele. Furthermore, a significant portion of its clientele was at risk due to the compromised data.

To mitigate potential risks, the company has initiated a customer outreach and notification process whilst offering 24 months of identity theft protection and credit monitoring to those affected. The company implemented signature-based detection systems to prevent similar incidents in the future.

The FBI and various regulatory authorities, including the Maine Attorney General’s office, were swiftly informed of the breach, and an ongoing investigation was launched.

The source of the attack has been linked to Scattered Spider, a known cybercrime collective that employs voice phishing and social engineering tactics. This incident reflects a broader trend of cyberattacks against the insurance sector, highlighting the critical vulnerabilities associated with third-party cloud service providers.

The Allianz Life incident highlights the urgent need for improved employee training on phishing and social engineering, as well as rigorous cybersecurity assessments and enhanced infrastructure.